Crédit Communautaire d’Afrique in Cameroon (CCA Bank), with the support of the European Investment Bank (EIB) and the IPC-Horus consortium, organized the CCA Business Club series in Yaoundé and then in Douala. Through these business clubs, the bank aims to offer business development services to their Micro, Small and Medium Enterprises (MSME) clients through discussions and training workshops.

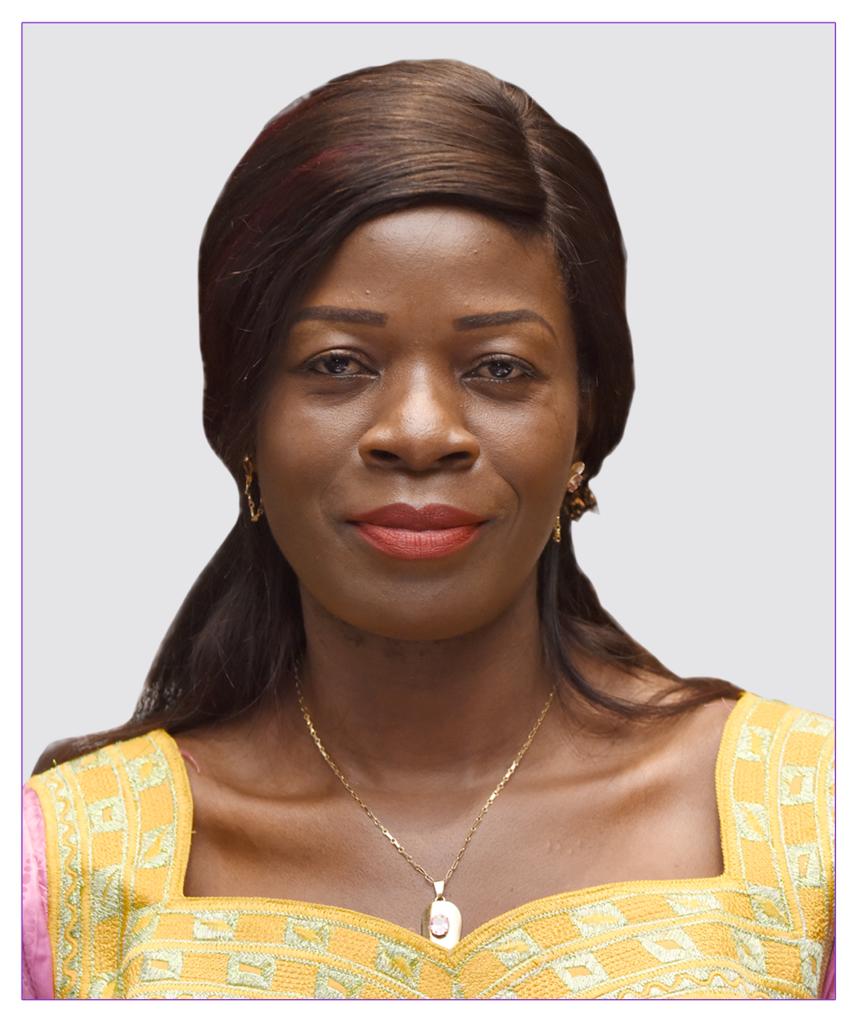

In this context, Ms. Tiwoda explains this initiative and tells us about the resulting impact on clients.

Introduce yourself and tell us about your institution

CCA-Bank is a Cameroonian universal bank with a capital of 13 billion seven hundred and fifty million. It existed under the label of micro finance institution for 21 years, before becoming the 15th official Bank of Cameroon on May 30, 2018. Today CCA-Bank has more than 501,000 customers, 533,399 bank accounts spread over 43 branches in the 10 Regions of Cameroon.

Describe the recently initiated business club format

The Business Club was developed as a training seminar on best practices in basic accounting management including cash management, introduction to basic taxation and experience sharing between CCA-Bank and its clients and then between clients.

How did your clients react to the recent business club events?

Clients were more than satisfied with the training, and many wanted the initiative to be repeated. They came out of it with clear and concrete notions on the areas concerning a better accounting follow-up of their activity and on the activities related to bank loans but most of all how to use them wisely.

What impact has the Business Club had on the institution?

In the analysis of SME credits, the documents submitted to our expertise in most cases are qualitatively unsatisfactory. In the case of the trained clients, we have observed an improvement in the quality of the loan applications and also in the daily management of their cash flow.

Can you describe the context in which you are working with EIB, the Technical Assistance you received, and what it has brought you?

Beyond the opening of a line of credit of more than 9 billion FCFA intended to support the resilience of private operators hard hit by the Covid-19 pandemic, the European Investment Bank acts as a partner of choice in achieving this common objective. Its technical assistance has provided us with external and strategic expertise in the training of our SME clients.

.