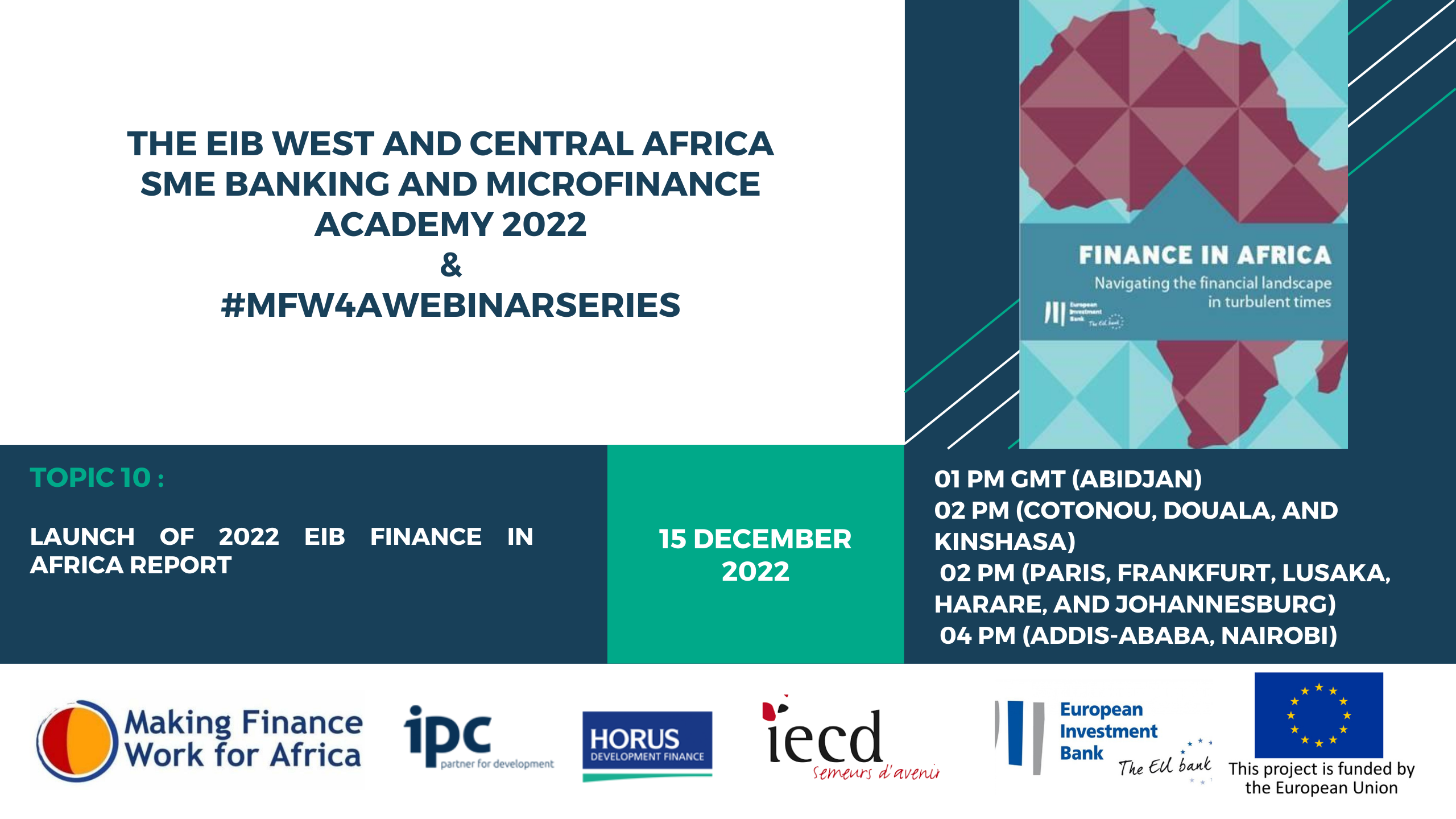

The EIB West and Central Africa SME Banking and Microfinance Academy 2022

Webinar series

Topic 10: Finance in Africa 2022 report: Navigating the financial landscape in turbulent times

15 December 2022, 01 pm GMT (Abidjan) / 02 pm (Cotonou, Douala, and Kinshasa, Paris, Frankfurt)/ 03 pm (Lusaka, Harare, and Johannesburg) / 04 pm (Addis-Ababa, Nairobi)

CONCEPT NOTE

1. Background and Introduction

Within the context of the European Investment Bank (EIB) Technical Assistance Financial Sector Programme for West and Central Africa, Making Finance Work for Africa (MFW4A) and the IPC, Horus and IECD Consortium are hosting a series of webinars for banks and microfinance institutions (MFIs) operating in these regions. EIB’s mission clearly aims to:

- to Micro Small and Medium Enterprises (MSMEs) in line with banking and microfinance institutions (MFIs) regulatory requirements, and

- (PFIs) deliver financial services on a credit worthiness basis, proactively managing their loan portfolios including present and future Non-Performing Loans (NPLs) and ensuring the safety of customer deposits.

MFW4A and the EIB are organizing the virtual launch of the 2022 EIB Finance in Africa Report. The tenth (10th) webinar will discuss the key results of Finance in Africa 2022 report: Navigating the financial landscape in turbulent times. This report is the outcome of a survey of 70 banks in sub-saharan Africa between April and June 2022 to learn their views on climate lending, gender lending, and the accelerating digitalization of the sector in the current unstable global environment. With central banks in many countries raising domestic interest rates and bond funding becoming more expensive due to tighter global financial conditions, banks are increasingly worried about funding costs.

2. Outcome

In addition to providing an overview of the current situation in the financial sector in Africa, one of the key aims of the webinar is to understand how banks and central banks are taking on current challenges.

3. Event format and audience

The webinar will last about 75 minutes and will be held in French with simultaneous translation in English. It will combine presentations followed by a Q&A session provoking a panel.

The target audience comprises middle and senior managers of banks and financial institutions operating in West & Central Africa. At the end of the webinar, key takeaways will be summarized in a post-event report and shared with participants and other stakeholders within the African financial ecosystem. A digital version will also be posted on MFW4A portal for public dissemination.

4. Tentative speakers

Introductory remarks: Head of European Investment Bank (EIB) Regional Representation in Central Africa (TBC)

Moderator: Marina Finken, MFW4A Coordinator

Speakers:

- Kwamina Duker, CEO, Development Bank of Ghana

- Ade Ayeyemi, Group CEO, Ecobank Transnational Incorporated (ETI)

- Colin Bermingham, Senior Economist, European Investment Bank (EIB)